Wine Accounting 101: Understanding the Basics

Wineries can maintain their books on an accrual basis within their accounting software. Their tax preparer can ake adjustments at tax time Bookkeeping for Veterinarians to conform their books to the cash basis if applicable. This process, generally managed by the tax preparer, involves reversing certain entries to align with tax reporting requirements.

Common Mistakes Wine Businesses Make in Their Accounting and How to Avoid Them

A well-structured chart of accounts will keep your financial reporting clear and accurate. By sorting your transactions in a meaningful way, your financial reports will be more meaningful. Your financial reports will move from being a cluttered mess to becoming a useful tool for planning and making decisions. The higher the shipping expense recovery ratio, the better, as this means you’re subsidizing less of the customer’s shipping expenses.

QuickBooks Online features we don’t use

- If you have more questions, need confirmation, or just want someone to take bookkeeping off of your hands altogether, we’re here to help.

- Another important aspect of cost accounting in vineyard operations is the use of standard costing.

- Even Intuit, the owner of Quickbooks, knows this, as they are rolling back their support for their QuickBooks Desktop versions.

- One advantage of using parent accounts is that you can view your financial reports in both collapsed and expanded forms.

This, in turn, can reduce the cost of your professional accounting services. Protea Financial is here to help you navigate the world of wine accounting. We have a team of experts who are familiar with the ins and outs of this industry. We can provide the tools and resources you need to manage your finances effectively. Our team can confidently answer your questions and guide you through the process easily, and we are here to help wherever we can. Wine accounting is an essential part of the wine industry, but it can often be daunting and confusing, especially for those new to the bookkeeping business.

- To make matters simpler, winery costs are broken down into specific cost categories according to steps in the winemaking process.

- These costs are only recognized as cost of goods sold as the wine is sold.

- These should be broken out from sales revenue and recorded in liability accounts.

- Beverage industry bookkeeping breaks down costs into two main groups.

- Consider an example where a winery has $500,000 in CoGS and $400,000 in average inventory for the year.

Overview of Accounting Methods

Established in 1991, Armus Corporation, a healthcare technology winery bookkeeping solution provider, sought assistance in finding a retirement plan that better suited the growing company. Knowing which category or categories you fall into will help ensure that you track the correct numbers. That way, you can price your products correctly and avoid having a loss for your business. If you want to spend your time doing what you do best, let the experts at Protea give you the luxury of not having to think about your books.

- Another method is Last-In, First-Out (LIFO), which assumes that the most recently produced items are sold first.

- You may also list out detailed subaccounts under payroll liabilities.

- Knowing which category or categories you fall into will help ensure that you track the correct numbers.

- Contact Protea Financial today to learn more about our services and how we can help you run your business more efficiently.

- We go beyond standard accounting and bookkeeping services to offer winery-specific financial analysis.

- Join 500+ business owners in the know, getting the latest accounting news in the wine business.

One note, however, you should never see a balance in an account called “Opening Balance Equity.” If you have one, you can guarantee your books need a bit of cleanup. For this reason, we keep the equity accounts In our winery chart of accounts template, very generic. And even different types of businesses within the same industry will have different accounts.

In the competitive wine market, sound accounting practices can significantly influence profitability and operational efficiency. The big difference with accrual accounting is that it adheres to the Matching Principle, which is a cornerstone of GAAP (Generally Accepted Accounting Principles). This Matching Principle dictates that expenses should be recorded in the same period as the revenues they help generate. For a winery, this means production costs like grapes and labor are not expensed immediately but are capitalized as inventory on the balance sheet. These costs are only recognized as cost of goods sold as the wine is sold.

Head to the bottom of the article to download your free winery chart of accounts template. However, if you aren’t currently using something like Dext, then this function in QuickBooks is worth looking into. Additionally, having the PDFs in QuickBooks Online is an invaluable audit trail. Getting your accounting into a cloud-based system is just the way of the future. Even Intuit, the owner of Quickbooks, knows this, as they are rolling back their support for their QuickBooks Desktop versions.

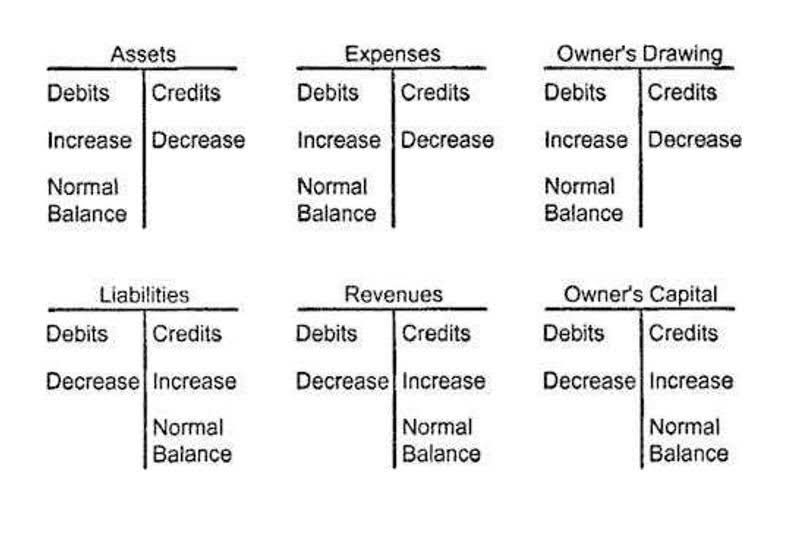

First, create temporary accounts within the “other expenses” section of your profit and loss (P&L) statement. To make things really simple for you, we’ve created a template chart of accounts that you can use for your winery. The Expense section of your chart of accounts contains your “GS&A” accounts–that is, your General, Selling, and Administrative expenses. You should consult with your accountant to see how they prefer this section of the chart of accounts to be organized.