What Book Value Means to Investors

Como Funciona O Omegle: Dicas Para Usar Em Segurança

October 20, 2024Париматч Parimatch Украина ️ Обзор Полной Версии Сайта Букмекерской Конторы Ставки На Спорт

October 21, 2024

Therefore, book value is roughly equal to the amount stockholders would receive if they decided to liquidate the company. If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases. If, for example, the company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, common equity increases along with BVPS.

What Is Price Per Book Value?

The formula doesn’t help individuals who aren’t involved in running a business. A business should detail all of the information you need to calculate book value on its balance sheet. Learn how to calculate the book value of an asset, how it helps businesses during tax season, and why it’s less helpful for individuals who don’t run a business. Accumulated depreciation of $65,000 has been charged to the machine as well as $45,000 in impairment charges.

Book Value of an Asset Formula

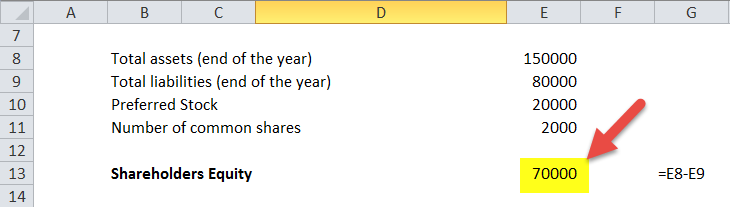

The book value of a company is equal to its total assets minus its total liabilities. The total assets and total liabilities are on the what are accounting advisory services company’s balance sheet in annual and quarterly reports. Profitable companies typically have market values greater than book values.

What Book Value Means to Investors

- Intangible assets, such as goodwill, are assets that you can’t see or touch.

- In contrast, market value is a company’s overall value based on the current share price and the total number of outstanding shares.

- Additionally, the company had accumulated minority interest of $6.49 billion.

- Market values shot high above book valuations and common sense during the 1920s and the dotcom bubble.

- Critics of book value are quick to point out that finding genuine book value plays has become difficult in the heavily-analyzed U.S. stock market.

Market values for many companies actually fell below their book valuations following the stock market crash of 1929 and during the inflation of the 1970s. Relying solely on market value may not be the best method to assess a stock’s potential. One way of comparing two companies is to calculate the book value per share (BVPS). One can calculate it by dividing shareholders’ equity by the total number of outstanding shares. For example, if a company has shareholders’ equity worth $5 million and 100,000 outstanding shares, its BVPS is $50. In simplified terms, it’s also the original value of the common stock issued plus retained earnings, minus dividends and stock buybacks.

Since book value is strictly an accounting and tax calculation, it may not always perfectly align with the fair market value of an asset. The carrying values of an asset can be calculated by subtracting the total liabilities of that particular asset from its total assets. In case the value obtained is negative, it means that the asset has a net loss or it can be said that its losses exceed its profits, thus making it a liability. The Bottom Line Using book value is one way to help establish an opinion on common stock value. Like other approaches, book value examines the equity holders’ portion of the profit pie. Unlike earnings or cash flow approaches, which are directly related to profitability, the book value method measures the value of the stockholders’ claim at a given point in time.

Which of these is most important for your financial advisor to have?

Additionally, the company had accumulated minority interest of $6.49 billion. After subtracting that, the net book value or shareholders’ equity was about $84.07 billion for Walmart during the given period. Because book value per share only considers the book value, it fails to incorporate other intangible factors that may increase the market value of a company’s shares, even upon liquidation. For instance, banks or high-tech software companies often have very little tangible assets relative to their intellectual property and human capital (labor force).

Equity investors often compare BVPS to the market price of the stock in the form of the market price/BVPS ratio to attribute a measure of relative value to the shares. Keep in mind that book value and BVPS do not consider the future prospects of the firm – they are only snapshots of the common equity claim at any given point in time. In personal finance, an investment’s carrying value is the price paid for it in shares/stock or debt. When this stock or debt is sold, the selling price less the book value is the capital gain/loss from an investment.Therefore, carrying value is the accounting value of the enterprise. In other words, it is the total value of the enterprise’s assets that owners would theoretically receive if an enterprise was liquidated. All other things being equal, a higher book value is better, but it is essential to consider several other factors.

They typically raise equity capital by listing the shares on the stock exchange through an initial public offering (IPO). Sometimes, companies get equity capital through other measures, such as follow-on issues, rights issues, and additional share sales. The examples given above should make it clear that book and market values are very different.

It can be defined as the net asset value of the firm or company that can be calculated as total assets, less intangible assets (goodwill, patents, etc.), and liabilities. Further, Book Value Per Share (BVPS) can be computed based on the equity of the common shareholders in the company. Total assets cover all types of financial assets, including cash, short-term investments, and accounts receivable. Physical assets, such as inventory, property, plant, and equipment, are also part of total assets. Intangible assets, including brand names and intellectual property, can be part of total assets if they appear on financial statements.